CONTENTS

What Does Tax-Free Shopping Mean in Japan?

If you’ve never shopped tax-free outside of an airport duty-free shop, the process can be a little intimidating. But tax-free shopping is set up to save foreign visitors money during their travels, so it’s worth trying on your next trip to Japan! And in the end, it’s actually pretty simple. Like many parts of the world, Japan charges sales tax on all purchases, at a rate of 10% for most products and 8% for food (except restaurants etc. which charge 10%). But short-term foreign travelers are, in theory, exempt from this tax. Of course, it would be impractical for every single cashier in Japan to suss out the situation of every single customer who makes a purchase every single day of the year. To make things easier for all involved, while still giving foreign visitors a chance to save on sales tax, there are a few simple conditions and procedures for shopping tax-free in Japan. Read on to find out everything you need to know!

Who Can Shop Tax-Free in Japan?

The vast majority of shoppers eligible for tax-free services in Japan are foreign visitors in Japan on a tourist visa (or in Japan with a visa exemption made for tourists, like most Americans, Brits, Australians, etc). Technically, the rule is that you must be a resident of a country other than Japan to be eligible for tax-free shopping, which means that foreign nationals in Japan on student or work visas for 6 months or more cannot shop tax-free, but Japanese citizens who are residing outside of Japan long-term actually can. If you’re just in Japan sightseeing for a few days or weeks, you’re most likely good to go!

What Products Are Eligible for Tax-Free Shopping?

In theory, just about any product you might buy could be eligible for tax-free shopping. The key factor is that tax-free purchases must be brought with you when you leave Japan, and used/consumed outside of the country. That means you must pay sales tax on restaurant bills, hotel fees, tickets, and other services in Japan. Food products might go either way – if you buy snacks to bring home as souvenirs, you can buy them tax-free. If you buy snacks to eat at your hotel in Tokyo, you’d better be paying sales tax on that, buddy! Just remember that purchases you plan to take with you when you leave Japan are generally eligible, and you’re golden. You can find a more detailed explanation on the Japanese Ministry of Finance website!

One important rule to keep in mind, however, is that tax-free services in Japan are only available for purchases of 5,000 yen or more – before tax. This is probably to keep the labor expended on tax-free procedures to a minimum, since it creates a little extra work for everyone down the line. The strategy clearly works, though, since many shoppers will condense the majority of their tax-free shopping to a few shopping trips. If you want to save on tax, consolidate purchases when possible to keep your total above 5,000 yen!

Where Can You Shop Tax-Free? What Should You Look For in Japan?

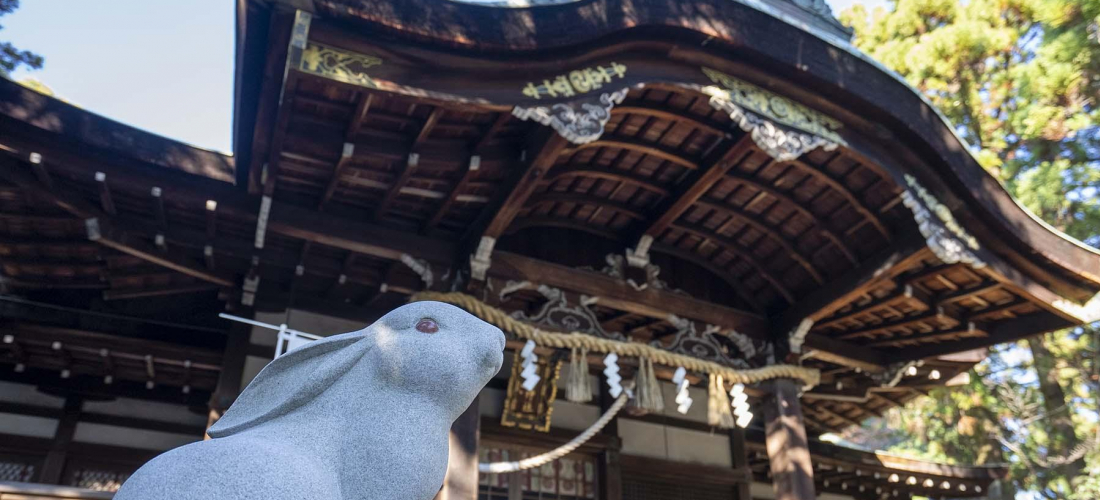

If you come from a country that doesn’t commonly offer tax-free shopping for visitors, you might be surprised to find that Japan actually has dedicated tax-free shops outside of airports! These shops aren’t exactly found on every corner, but you might spy one in a neighborhood where travelers congregate. They often sell cosmetics and alcohol, as you might expect, but also less obvious products like rice cookers and other small household appliances.

Tax-free shopping is also commonly available at ordinary retailers like drug stores, clothing shops, department stores, and even sometimes convenience stores – especially chains and larger shops in areas with plenty of foreign shoppers. Most places will make it clear with a big sign or a sticker in the window stating “TAX-FREE” in clearly written English!

If the shop is a small local establishment and you don’t see any signs declaring tax-free shopping an option, it probably isn’t. But if you’re unsure, you can always ask! The word for “tax-free” in Japanese is “menzei” (免税, pronounced men-zey), and just asking about “menzei” is usually enough for shop staff to understand. Either they’ll point you in the right direction, or say no.

Common Japanese Tax-Free Shopping Procedures

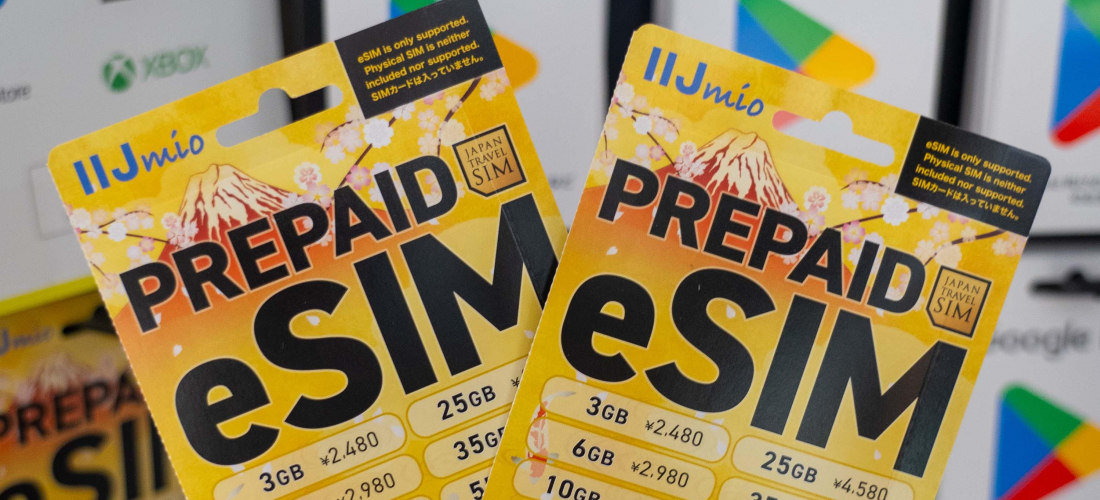

Generally there are two ways to exempt yourself from paying sales tax on a purchase in Japan – by either paying the tax-free price in the first place, or getting a tax refund – and the correct procedure will depend on the shop itself. Most shops with tax-free shopping offer the first option, where you simply pay the tax-free price at checkout. At bigger shops with a lot of foreign shoppers, there might even be a dedicated tax-free checkout! At smaller shops, you’ll probably just line up with all the other customers, and let the shop staff know before you pay. (Try letting them know by asking for “menzei”!) The cashier will ask for your passport so they can check your eligibility and register your purchase, and then all you have to do is pay the discounted price. (If you’re planning to shop tax-free, make sure you get your passport stamped on the way into Japan instead of using an automated gate, because shop staff will need to check it to ensure your temporary visitor status.)

The tax refund process is more common at department stores, where you can shop from multiple departments and brands with separate registers. In this case, you initially pay the full price including tax on each purchase, before bringing all of your receipts to the facility’s tax refund counter, where they do exactly what you might expect – check your passport, add up all of your purchases, calculate the tax, and then issue a refund for the total.

Bringing Your Purchases Home

Once you’ve made your purchase, some shops may put your items into a sealed plastic bag labeled “tax-free,” to ensure that you don’t use or consume the items inside while you’re still in Japan. You’ll want to keep all the products inside those bags until you’ve left Japan, and you generally need to keep track of all tax-free purchases, bagged or not. The law requires you to bring your tax-free purchases with you when you leave, and technically you’re supposed to let airline staff know if you have tax-free items in your suitcase when you check your bags, because Japanese customs officials are within their purview to check your bags and verify that no tax-free items have been consumed or left in Japan. These checks, however, are somewhat uncommon for everyday shoppers, and generally reserved for travelers who have purchased high-priced items in Japan. If you’re planning to fill your suitcase with designer bags or luxury watches, stay organized and try to keep your purchases easily accessible. If you’re just bringing home some Japanese snacks and cosmetics, follow the law and be aware that your tax-free purchases might be checked, but don’t worry about it too much – the normal passport scan when you pass through customs is usually enough.

Make the Most of Tax-Free Shopping in Japan!

It doesn’t take much effort to shop tax-free in Japan, and since foreign travelers in Japan are legally obligated to keep their passports with them at all times anyway, there should be nothing standing in the way of you paying tax-free prices and saving lots of money in Japan!

If you want an even better deal, check out these Japankuru coupons that can be combined with the tax-free discount:

・Tax-free prices plus an extra 5% off on Japanese glasses at JINS.

・Tax-free prices plus an extra 3~7% off on electronics, cameras, watches, toys, cosmetics, food, and much more at KOJIMA x BicCamera.

・Tax-free prices plus an extra 5% off on Japanese kitchen knives at Musashi Japan.

For more info and updates from Japan, check Japankuru for new articles, and don’t forget to follow us on X (Twitter), Instagram, and Facebook!

Half a lifetime ago I came to Japan for a semester abroad... and I never left. I guess I really like the place! I spent my first few years in Japan living in the middle of nowhere, so I'd love to hear your Tokyo recommendations via Japankuru's social media accounts!

COMMENT

FEATURED MEDIA

VIEW MORE

A New Tokyo Animal Destination: Relax & Learn About the World’s Animals in Japan

#pr #japankuru #anitouch #anitouchtokyodome #capybara #capybaracafe #animalcafe #tokyotrip #japantrip #카피바라 #애니터치 #아이와가볼만한곳 #도쿄여행 #가족여행 #東京旅遊 #東京親子景點 #日本動物互動體驗 #水豚泡澡 #東京巨蛋城 #เที่ยวญี่ปุ่น2025 #ที่เที่ยวครอบครัว #สวนสัตว์ในร่ม #TokyoDomeCity #anitouchtokyodome

Shohei Ohtani Collab Developed Products & Other Japanese Drugstore Recommendations From Kowa

#pr #japankuru

#kowa #syncronkowa #japanshopping #preworkout #postworkout #tokyoshopping #japantrip #일본쇼핑 #일본이온음료 #오타니 #오타니쇼헤이 #코와 #興和 #日本必買 #日本旅遊 #運動補充能量 #運動飲品 #ช้อปปิ้งญี่ปุ่น #เครื่องดื่มออกกำลังกาย #นักกีฬา #ผลิตภัณฑ์ญี่ปุ่น #อาหารเสริมญี่ปุ่น

도쿄 근교 당일치기 여행 추천! 작은 에도라 불리는 ‘가와고에’

세이부 ‘가와고에 패스(디지털)’ 하나면 편리하게 이동 + 가성비까지 완벽하게! 필름카메라 감성 가득한 레트로 거리 길거리 먹방부터 귀여움 끝판왕 핫플&포토 스폿까지 총집합!

Looking for day trips from Tokyo? Try Kawagoe, AKA Little Edo!

Use the SEIBU KAWAGOE PASS (Digital) for easy, affordable transportation!

Check out the historic streets of Kawagoe for some great street food and plenty of picturesque retro photo ops.

#pr #japankuru #도쿄근교여행 #가와고에 #가와고에패스 #세이부패스 #기모노체험 #가와고에여행 #도쿄여행코스 #도쿄근교당일치기 #세이부가와고에패스

#tokyotrip #kawagoe #tokyodaytrip #seibukawagoepass #kimono #japantrip

Hirakata Park, Osaka: Enjoy the Classic Japanese Theme Park Experience!

#pr #japankuru #hirakatapark #amusementpark #japantrip #osakatrip #familytrip #rollercoaster #retrôvibes #枚方公園 #大阪旅遊 #關西私房景點 #日本親子旅行 #日本遊樂園 #木造雲霄飛車 #히라카타파크 #สวนสนุกฮิราคาตะพาร์ค

🍵Love Matcha? Upgrade Your Matcha Experience With Tsujiri!

・160년 전통 일본 말차 브랜드 츠지리에서 말차 덕후들이 픽한 인기템만 골라봤어요

・抹茶控的天堂!甜點、餅乾、飲品一次滿足,連伴手禮都幫你列好清單了

・ส่องมัทฉะสุดฮิต พร้อมพาเที่ยวร้านดังในอุจิ เกียวโต

#pr #japankuru #matcha #matchalover #uji #kyoto #japantrip #ujimatcha #matchalatte #matchasweets #tsujiri #말차 #말차덕후 #츠지리 #교토여행 #말차라떼 #辻利抹茶 #抹茶控 #日本抹茶 #宇治 #宇治抹茶 #日本伴手禮 #抹茶拿鐵 #抹茶甜點 #มัทฉะ #ของฝากญี่ปุ่น #ชาเขียวญี่ปุ่น #ซึจิริ #เกียวโต

・What Is Nenaito? And How Does This Sleep Care Supplement Work?

・你的睡眠保健品——認識「睡眠茶氨酸錠」

・수면 케어 서플리먼트 ‘네나이토’란?

・ผลิตภัณฑ์เสริมอาหารดูแลการนอน “Nenaito(ネナイト)” คืออะไร?

#pr #japankuru #sleepcare #japanshopping #nenaito #sleepsupplement #asahi #睡眠茶氨酸錠 #睡眠保健 #朝日 #l茶胺酸 #日本藥妝 #日本必買 #일본쇼핑 #수면 #건강하자 #네나이토 #일본영양제 #อาหารเสริมญี่ปุ่น #ช้อปปิ้งญี่ปุ่น #ร้านขายยาญี่ปุ่น #ดูแลตัวเองก่อนนอน #อาซาฮิ

Japanese Drugstore Must-Buys! Essential Items from Hisamitsu® Pharmaceutical

#PR #japankuru #hisamitsu #salonpas #feitas #hisamitsupharmaceutical #japanshopping #tokyoshopping #traveltips #japanhaul #japantrip #japantravel

Whether you grew up with Dragon Ball or you just fell in love with Dragon Ball DAIMA, you'll like the newest JINS collab. Shop this limited-edition Dragon Ball accessory collection to find some of the best Dragon Ball merchandise in Japan!

>> Find out more at Japankuru.com! (link in bio)

#japankuru #dragonball #dragonballdaima #animecollab #japanshopping #jins #japaneseglasses #japantravel #animemerch #pr

This month, Japankuru teamed up with @official_korekoko to invite three influencers (originally from Thailand, China, and Taiwan) on a trip to Yokohama. Check out the article (in Chinese) on Japankuru.com for all of their travel tips and photography hints - and look forward to more cool collaborations coming soon!

【橫濱夜散策 x 教你怎麼拍出網美照 📸✨】

每次來日本玩,是不是都會先找旅日網紅的推薦清單?

這次,我們邀請擁有日本豐富旅遊經驗的🇹🇭泰國、🇨🇳中國、🇹🇼台灣網紅,帶你走進夜晚的橫濱!從玩樂路線到拍照技巧,教你怎麼拍出最美的夜景照。那些熟悉的景點,換個視角說不定會有新發現~快跟他們一起出發吧!

#japankuru #橫濱紅磚倉庫 #汽車道 #中華街 #yokohama #japankuru #橫濱紅磚倉庫 #汽車道 #中華街 #yokohama #yokohamaredbrickwarehouse #yokohamachinatown

If you’re a fan of Vivienne Westwood's Japanese designs, and you’re looking forward to shopping in Harajuku this summer, we’ve got important news for you. Vivienne Westwood RED LABEL Laforet Harajuku is now closed for renovations - but the grand reopening is scheduled for July!

>> Find out more at Japankuru.com! (link in bio)

#japankuru #viviennewestwood #harajuku #omotesando #viviennewestwoodredlabel #viviennewestwoodjapan #비비안웨스트우드 #오모테산도 #하라주쿠 #日本購物 #薇薇安魏斯伍德 #日本時尚 #原宿 #表參道 #japantrip #japanshopping #pr

Ready to see TeamLab in Kyoto!? At TeamLab Biovortex Kyoto, the collective is taking their acclaimed immersive art and bringing it to Japan's ancient capital. We can't wait to see it for ourselves this autumn!

>> Find out more at Japankuru.com! (link in bio)

#japankuru #teamlab #teamlabbiovortex #kyoto #kyototrip #japantravel #artnews

Photos courtesy of teamLab, Exhibition view of teamLab Biovortex Kyoto, 2025, Kyoto ® teamLab, courtesy Pace Gallery

Japanese Makeup Shopping • A Trip to Kamakura & Enoshima With Canmake’s Cool-Toned Summer Makeup

#pr #canmake #enoshima #enoden #에노시마 #캔메이크 #japanesemakeup #japanesecosmetics

⚔️The Robot Restaurant is gone, but the Samurai Restaurant is here to take its place. Check it out, and don't forget your coupon!

🍣신주쿠의 명소 로봇 레스토랑이 사무라이 레스토랑으로 부활! 절찬 쿠폰 발급중

💃18歲以上才能入場的歌舞秀,和你想的不一樣!拿好優惠券去看看~

#tokyo #shinjuku #samurairestaurant #robotrestaurant #tokyotrip #도쿄여행 #신주쿠 #사무라이레스토랑 #이색체험 #할인이벤트 #歌舞伎町 #東京景點 #武士餐廳 #日本表演 #日本文化體驗 #japankuru #japantrip #japantravel #japanlovers #japan_of_insta

Japanese appliance & electronics shopping with our KOJIMA x BicCamera coupon!

用JAPANKURU的KOJIMA x BicCamera優惠券買這些正好❤️

코지마 x 빅 카메라 쿠폰으로 일본 가전 제품 쇼핑하기

#pr #japankuru #japanshopping #kojima #biccamera #japaneseskincare #yaman #dji #osmopocket3 #skincaredevice #日本購物 #美容儀 #相機 #雅萌 #日本家電 #일본여행 #면세 #여행꿀팁 #일본쇼핑리스트 #쿠폰 #일본쇼핑 #일본브랜드 #할인 #코지마 #빅카메라 #japankurucoupon